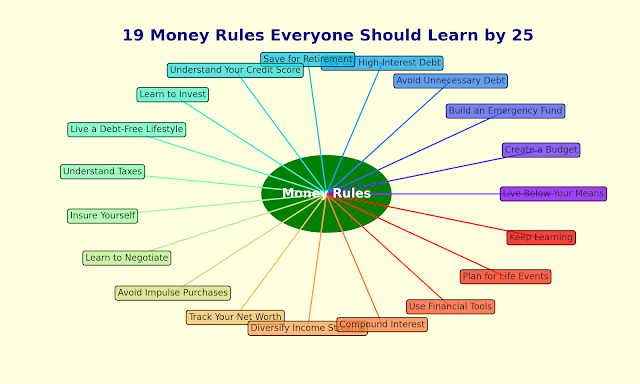

19 Money Rules Everyone Should Learn by 25

Introduction:

In today’s fast-paced world, financial literacy is more important than ever. Learning the fundamentals of managing money by the age of 25 can set you on a path to financial security and success. These 19 money rules will help you build a solid financial foundation and make informed decisions that benefit your future.

1. Live Below Your Means:

Living below your means is the cornerstone of financial health. It means spending less than you earn and avoiding the temptation to keep up with the Joneses. To achieve this:

-

Track your spending to identify areas where you can cut back.

-

Prioritize needs over wants.

-

Practice frugality by seeking discounts, using coupons, and buying used items when possible.

2. Create a Budget and Stick to It:

A budget is a powerful tool that helps you manage your money effectively. It allows you to plan for expenses, save for goals, and avoid debt. To create a budget:

-

List all your income sources and monthly expenses.

-

Categorize your expenses (e.g., housing, food, entertainment).

-

Allocate a portion of your income to each category, ensuring you live within your means.

-

Use budgeting tools and apps like Mint, YNAB, or PocketGuard to help you stay on track.

3. Build an Emergency Fund:

An emergency fund is a savings buffer for unexpected expenses, such as medical bills or car repairs. Aim to save three to six months’ worth of living expenses. To build an emergency fund:

-

Set up automatic transfers from your checking account to a dedicated savings account.

-

Start small if necessary and gradually increase your contributions.

-

Avoid using this fund for non-emergencies.

4. Avoid Unnecessary Debt:

Not all debt is bad, but unnecessary debt can hinder your financial progress. Understand the difference:

-

Good debt includes loans for education, a mortgage, or investments that increase in value.

-

Bad debt includes high-interest credit card debt or loans for depreciating assets.

-

Use credit cards responsibly by paying off the balance in full each month.

-

Avoid payday loans and other high-interest lending options.

5. Pay Off High-Interest Debt First:

High-interest debt can quickly spiral out of control due to compound interest. Prioritize paying off these debts to save money in the long run. Two common strategies are:

-

Debt snowball: Pay off the smallest debts first to gain momentum.

-

Debt avalanche: Pay off the highest interest rate debts first to minimize interest costs.

6. Save for Retirement Early:

The earlier you start saving for retirement, the more you can benefit from compound interest. Consider these steps:

-

Contribute to employer-sponsored retirement plans like a 401(k), especially if they offer matching contributions.

-

Open an Individual Retirement Account (IRA) for additional savings.

-

Aim to save at least 10-15% of your income for retirement.

7. Understand and Improve Your Credit Score:

Your credit score affects your ability to get loans, rent an apartment, and even land a job. To maintain a good credit score:

-

Pay your bills on time.

-

Keep your credit utilization ratio below 30%.

-

Avoid opening too many new credit accounts at once.

-

Regularly check your credit report for errors and dispute any inaccuracies.

8. Learn to Invest:

Investing helps your money grow over time. Start with the basics:

-

Understand different types of investments (stocks, bonds, mutual funds, ETFs).

-

Diversify your portfolio to spread risk.

-

Invest for the long term rather than trying to time the market.

-

Consider low-cost index funds as a simple way to start investing.

9. Live a Debt-Free Lifestyle:

Strive to avoid lifestyle inflation, where increased income leads to increased spending. Instead:

-

Focus on saving and investing additional income.

-

Practice mindful spending and avoid impulse purchases.

-

Prioritize financial goals like paying off debt and building wealth over unnecessary luxury items.

10. Understand Taxes:

Taxes are an unavoidable part of life, so it’s crucial to understand how they work:

-

Learn the basics of federal, state, and local taxes.

-

Take advantage of tax deductions and credits to reduce your tax liability.

-

Keep organized records of your income and expenses for easier tax filing.

-

Consider using tax software or consulting a tax professional if your situation is complex.

11. Insure Yourself and Your Assets:

Insurance protects you from financial loss due to unforeseen events. Common types include:

-

Health insurance to cover medical expenses.

-

Life insurance to provide for your dependents in case of your death.

-

Auto insurance to cover vehicle-related incidents.

-

Renters or homeowners insurance to protect your belongings and property.

-

Understand your policies and ensure you have adequate coverage.

12. Learn to Negotiate:

Negotiation can save you money and increase your income. Practice negotiating in various aspects of life:

-

Negotiate your salary and benefits when accepting a new job.

-

Negotiate bills and subscriptions, such as phone or cable services.

-

Practice negotiating prices when making significant purchases.

13. Avoid Impulse Purchases:

Impulse buying can derail your budget and savings goals. To avoid it:

-

Implement a 24-hour rule: wait a day before making non-essential purchases.

-

Create a shopping list and stick to it.

-

Unsubscribe from marketing emails and avoid browsing online stores for entertainment.

14. Keep Track of Your Net Worth:

Knowing your net worth gives you a clear picture of your financial health. To track it:

-

List all your assets (cash, investments, property) and liabilities (debts, loans).

-

Subtract your liabilities from your assets to calculate your net worth.

-

Regularly update your net worth to monitor your progress and adjust your financial plan.

15. Diversify Your Income Streams:

Relying on a single source of income can be risky. Diversifying your income provides financial security. Consider:

-

Developing a side hustle or freelance work.

-

Investing in income-generating assets like rental properties or dividend stocks.

-

Creating passive income streams, such as a blog, online courses, or royalties.

16. Understand the Power of Compound Interest:

Compound interest can significantly boost your savings over time. Here’s how it works:

-

Interest is earned on both the initial principal and the accumulated interest from previous periods.

-

The earlier you start saving or investing, the more you benefit from compounding.

-

Use compound interest calculators to see the potential growth of your investments.

17. Make Use of Financial Tools and Resources:

Various tools and resources can help you manage your finances effectively. Some recommendations include:

-

Budgeting apps like Mint, YNAB, and PocketGuard.

-

Investment platforms like Vanguard, Fidelity, and Robinhood.

-

Educational resources such as personal finance books, podcasts, and blogs.

18. Plan for Major Life Events:

Life events like buying a house, getting married, or having children require financial planning. To prepare:

-

Set specific savings goals for each event.

-

Research the costs associated with these events and create a budget.

-

Adjust your financial plan as needed to accommodate these milestones.

19. Keep Learning and Stay Informed:

Financial education is an ongoing process. Stay informed by:

-

Reading personal finance books, blogs, and articles.

-

Listening to financial podcasts and attending webinars.

-

Joining financial communities or forums to exchange knowledge and experiences.

-

Staying updated on financial news and market trends.

Conclusion:

Learning these 19 money rules by the age of 25 can set you on a path to financial independence and security. By implementing these strategies, you’ll be better equipped to make informed financial decisions, avoid common pitfalls, and achieve your long-term financial goals. Start today, and your future self will thank you.